New Reporting Requirements for Businesses

Understanding The New Beneficial Ownership Information (BOI) Rule

In 2016, the Financial Crimes Enforcement Network (FinCEN) began requiring all financial institutions (FIs) – credit unions and banks alike – to collect Beneficial Ownership Information (BOI) for business customers. The purpose of BOI reporting is to help FinCEN stop the formation of anonymous shell companies, and to prevent illicit crime.

Navigating The Changes: New Reporting Requirements For Small Businesses

On January 1, 2024, new businesses must actively submit their Beneficial Ownership Information (BOI) electronically to FinCEN via a database named BOSS (Beneficial Ownership Secure System). The reporting process entails providing essential details such as names, dates of birth, addresses, and other identifying information for individuals holding a significant stake in the company.

For existing businesses registered before January 1, 2004, the deadline for completing their BOI reporting is January 1, 2025.

Who Is A Beneficial Owner?

A beneficial owner is any individual who exercises substantial control over a company, or who owns or controls at least 25% of a company.

Does My Company Have To Report Its Beneficial Owners?

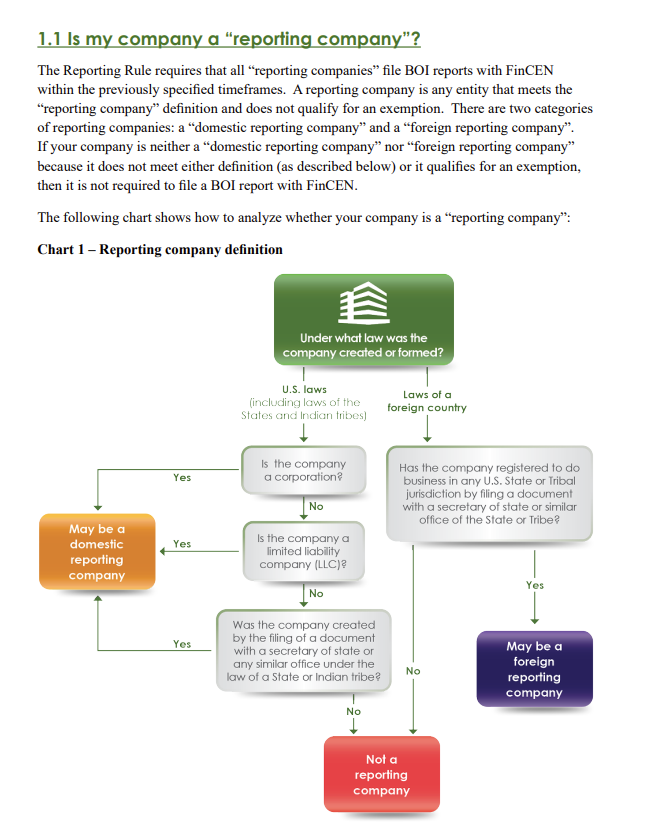

While certain types of entities are exempt, small corporations or LLCs will likely need to actively report their beneficial ownership information to FinCEN. A key factor in determining whether your company will have to report is whether you had to file a document with your state’s Secretary of State, or similar office, to create your company.

Why Is Reporting BOI Important For Your Company?

- Fines & Penalties. It’s important for businesses to comply with this rule to stay compliant. Failure to self-report BOI information can result in hefty fines and penalties.

- Counteract Money Laundering & Fraud. The purpose of this new requirement is to help the government curb and detect money laundering, fraud and other illegal activities by making it more difficult for individuals to hide their involvement and stake in a business.

- Legal Repercussions. Failure to comply may lead to legal proceedings actively initiated against the company to enforce compliance.

What Specific Information Must Be Reported?

To actively comply, a reporting company must provide: (1) its legal name and any trade name or DBA; (2) its address; (3) the jurisdiction in which it formed or registered, depending on whether it’s a U.S. or foreign company; and (4) its Taxpayer Identification Number (TIN).

For each of your company’s beneficial owners and each company applicant (if required), your company will need to provide the individual’s: (1) legal name; (2) birthdate; (3) address (in most cases, a home address); and (4) an identifying number from a driver’s license, passport, or other approved document for each individual, as well as an image of the document that the number is from.

What Resources Are Available To Learn More?

FinCEN has created many resources to help businesses understand and comply with the new rule.

- FinCEN Small Entity Compliance Guide

- FinCEN Beneficial Ownership Page

- FinCEN BOI FAQs

- FinCEN Beneficial Ownership Reporting – Key Questions

- FinCEN’s Final Rule and Rule Fact Sheet

- FinCEN’s Contact Page for Questions

Who Should I Contact For Questions?

If you have specific questions about FinCEN’s BOI reporting rule, you can contact FinCEN directly through:

- FinCEN’s Online Contact Form

- Email to FRC@fincen.gov

- Leaving a message on FinCEN’s Regulatory Helpline at 1-800-767-2825.