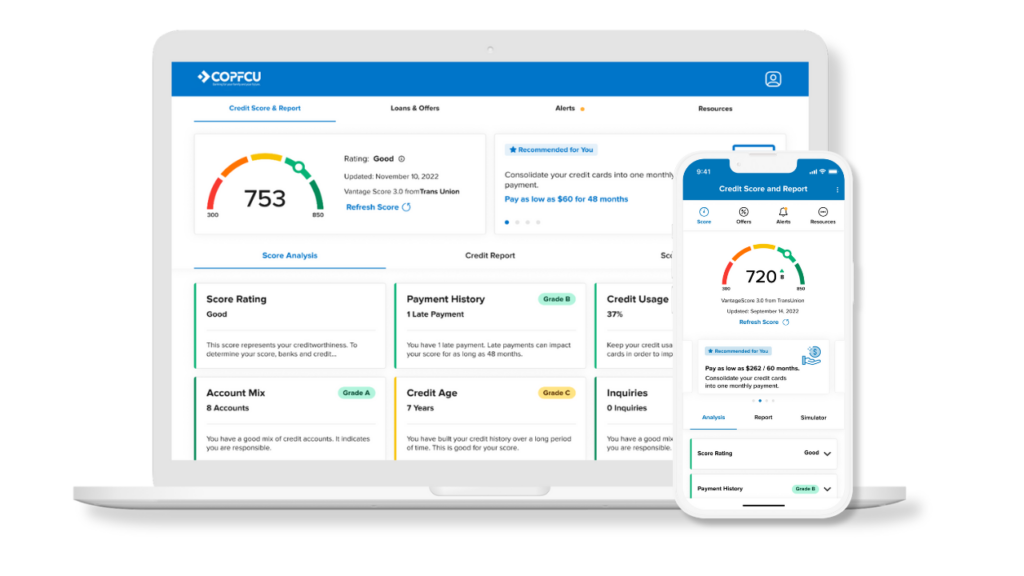

Introducing Credit Score by Savvy Money

Free ongoing credit score, reporting and monitoring

Credit Score by Savvy Money is a FREE service that gives you access to your full credit score and report directly inside Online and Mobile Banking. Credit Score also gives you access to financial tips and education, credit offers based on your score, credit monitoring alerts and more!

Key Benefits of Credit Score:

- Free access to your credit score, full credit report, and credit monitoring

- Track your score daily without it ever being negatively affected

- Use the score simulator to see what happens to your score if you were to take certain actions

- Money saving offers from COPFCU that can help you reduce your interest costs

- No extra apps to install – Credit Score is accessible within Online Banking & the COPFCU Mobile app

How to Enroll in Credit Score

- Login to Online or Mobile Banking

- Click “Get Started” on the Credit Score Widget. If using the mobile app, click Accounts and scroll to the bottom of the screen to locate the Credit Score widget.

- Accept the terms of agreement