Welcome Butler Heritage Members

We’re excited to welcome you to COPFCU.

We’re pleased to welcome you to COPFCU! As of June 30, 2025, Butler Heritage Federal Credit Union was placed into liquidation by the NCUA, and your memberships and accounts are now in our care. Rest assured: your money is safe, your accounts are still insured, and we’re committed to providing you with the enhanced technology, local support, and financial tools you deserve.

Important Information for BHFCU Members

Updated October 1, 2025

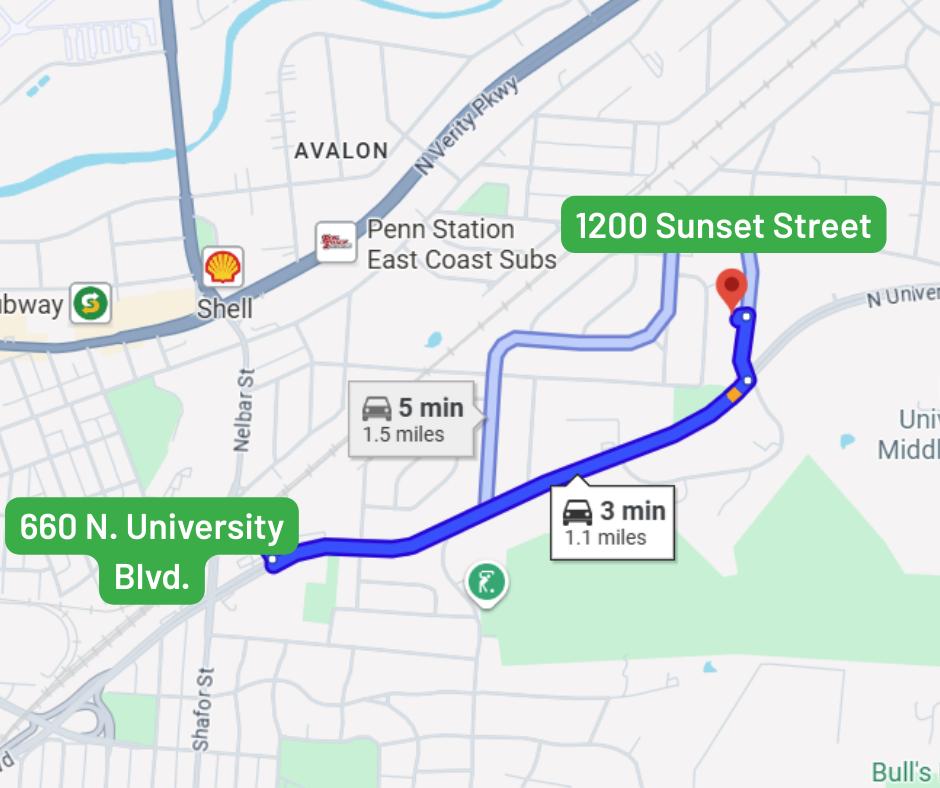

As of September 30, the Middletown Branch at 660 N. University Blvd. has officially closed. We’re excited to share that a new temporary branch location is opening soon to continue serving your financial needs until the new Fairfield Township Branch is ready.

Temporary Middletown Branch Opening Soon

We’ve secured a convenient temporary branch in Middletown located at 1200 Sunset Street — just 1 mile from the previous location.

This branch is tentatively expected to open on Monday, October 6 and will provide the same friendly service and full range of transactions you rely on, including deposits, withdrawals, loan payments, and account assistance.

Even More Ways to Access Your Accounts

In addition to the new temporary branch, you can also take advantage of the Shared Branching Network where you can make deposits, withdrawals, loan payments and more at participating credit unions nationwide. Just bring your driver’s license and COPFCU account number.

Nearby Shared Branching Locations:

- MyUSA Credit Union – 1201 Crawford St., Middletown, OH 45044 (1.5 miles away)

Hours: Mon–Fri 9:00–5:00 | Sat 9:00–12:00 - MyUSA Credit Union – 3600 Towne Blvd., Middletown, OH 45005 (3.2 miles away)

Hours: Mon–Fri 9:00–6:00 | Sat 9:00–12:00 - River Valley Credit Union – 815 Elliott Dr, Middletown, OH 45044 (3.7 miles away)

Hours: Mon–Fri 9:00–5:00 | Sat 9:00–1:00 - MyUSA Credit Union – 933 W. State St., Trenton, OH 45067 (5.8 miles away)

Hours: Mon–Fri 9:00–5:00 | Sat 9:00–12:00

Find more Shared Branching locations.

Free ATM Access

You can use your COPFCU debit card at thousands of surcharge-free ATMs nationwide through the Shared Branching and Alliance One networks.

Nearby Free ATMs include:

- MyUSA Credit Union (all 3 Middletown/Trenton locations above)

- Sorg Bay West FCU – 400 N. Board St., Middletown

- PNC ATM inside UDF – 101 N. Verity Pkwy., Middletown

- PNC ATM – 3359 Towne Blvd., Middletown

- River Valley CU – 815 Elliott Dr., Middletown

Find surcharge-free ATMs near you.

Phone Support

Our Member Support Center is available to help with account and loan needs:

📞 1-800-810-0221

Hours: Mon–Fri 8:30–5:00 | Sat 9:00–1:00

View the Full Member Communication

You can review the full letter that was mailed to members for complete details here: View Full Letter (PDF)

On June 30, 2025 the National Credit Union Administration (NCUA) closed and placed into liquidation Butler Heritage Federal Credit Union. The NCUA has entered into a purchase and assumption agreement with Cincinnati Ohio Police Federal Credit Union (COPFCU).

As part of the Purchase and Assumption Agreement with Butler Heritage Federal Credit Union, your accounts are being transitioned to COPFCU systems. We’re honored to serve you and excited to provide access to enhanced financial tools, services, and technology, backed by the personal service you’ve come to expect.

If you have questions about your accounts or the transition, please call us at 1-800-810-0221 or email info@copfcu.com.

Transition Details & Resources

Access letters, updates and important details about the transition.

- Important Information About Your Credit Union

- Transition Details and Plan

- How to Access COPFCU Systems

Questions or Concerns? We’re Here to Help.

We understand that the sudden nature of this transition could cause some confusion and concerns. Please don’t hesitate to call us at 1-800-810-0221 or stop by a branch. You can also visit this page — copfcu.com/BHmembers — for ongoing updates.

Support from NCUA

You may make claims for share insurance to NCUA as Liquidating Agent. You have eighteen (18) months from the date of the appointment of the Liquidating Agent in which to make claims to the Liquidating Agent for share insurance. This period ends December 31, 2026. Failure to make claims before that date will act as a bar to such claims.

To make a share insurance claim with NCUA as the Liquidating Agent, contact:

Cincinnati Ohio Police Federal Credit Union

c/o National Credit Union Administration

10910 Domain Drive, Suite 200

Austin, Texas 78758

512-231-7940

Why Did the NCUA Choose COPFCU?

Financial Strength & Stability

COPFCU is financially sound and holds the NCUA’s highest possible rating. With a strong capital ratio of 11%, reserves of $19 million, and $439,679 in year-to-date net income (as of May 2025), we exceed industry averages in asset quality and performance. Additionally, COPFCU ranks first in the local market across nearly all key metrics used to measure the value of our return to the membership.

Shared Mission & Community Roots

Founded to serve Cincinnati Police Officers, COPFCU shares a deep community commitment similar to BHFCU’s origins with Middletown City employees. We now serve public servants across police, fire, education, and more.

Exceptional Member Service

COPFCU’s Net Promoter Score of 73 places us in the “exceptional” range (70–100), well above the 2024 financial industry average of 44.

Expanded Access

You will enjoy:

- Over 5,000 Co-op shared branches

- More than 60,00 surcharge-free ATMs nationwide

- Coming soon! New full-service branch in Hamilton at 6718 Gilmore Road, featuring two drive-thru lanes, a drive-up ATM and a community room.

Convenient Banking Service

Expanded digital capabilities include:

- Online account opening

- Online loan applications with eSigning

- Mobile app and online banking with bill pay

- Mobile check deposit

- Card controls with transactions alerts

- Person-to-Person (P2P) payments

- Account-to-Account (A2A) transfers

Giving Back to Our Members

Exclusive member-only benefits:

- Rewards Plus – receive deposit rate bonuses and loan rate rebates based on your overall engagement*

- Scholarship program – $15,500 awarded annually to members

- Local and national attraction discounts

Committed to Community

COPFCU is committed to improving the communities we serve including:

- Ronald McDonald House – Taste of Hope

- FreeStore Foodbank – Bea Taylor Market

- Police & fire charity events

- … and more!

We Are Honored to Serve You

We are thrilled to have you as part of our COPFCU family and we look forward to serving you with the same dedication, heart and upgraded products and services that all COPFCU members have come to expect.